Banks, Fintechs, TransUnion Cibil, and Other Tales

Topic

- Around India with MoneyTap 1

- Consumer Durable 1

- Credit Cards 32

- Credit Score 27

- Finance 33

- General 52

- Know MoneyTap Better 26

- MoneyTap 50

- MoneyTap in Daily Life 38

- Personal Loan 86

- Shopping on EMI 4

- Wedding Loan 1

Let me tell you a story.

Ram is a salaried individual who has never borrowed money from credit institutions or banks. He has done well for himself and has never needed a credit card or personal loan. Due to some unforeseen circumstances, he now needs a large amount of money and decided to finally approach a credit institution for a loan.

However, Ram soon finds that his loan application has been rejected.

Here’s why.

Traditionally, credit works on information about the loan applicant–their repayment ability, credit score, spending habits, etc.

And without a credit history, it is very difficult for banks or credit institutions to assess a prospect’s intent or ability to repay. That’s why NTC (New to Credit) individuals don’t often get positive responses from traditional lending organizations like banks.

You can understand how frustrating it can be for someone who has never applied for credit. To get credit they must have a credit history but they can’t have a credit history unless they’ve been given credit.

TransUnion CIBIL’s CreditVision NTC Score plans to address this catch-22 situation. The objective of their credit scoring solution is to enable credit institutions to assess the eligibility of NTC customers.

The CreditVision NTC Score incorporates an algorithm that uses an adaptive machine learning

framework to continuously monitor behavioural trends of similar subjects to capture any

major shifts in trends or variables. For instance if Ram, from the earlier example, who has never taken a loan, shows spending and saving patterns similar to other individuals who’ve built creditworthiness, his CreditVision NTC Score will show him as creditworthy too.

This is a great move to open up the credit market to previously uncatered customers. However, we at MoneyTap, and many other fintechs and digital lenders have been studying and finding ways to offer credit to NTC customers for a while now.

Credit without a credit score

Yes, it’s difficult to analyse and form an opinion about a customer without a credit score.

Complexities arise while profiling a prospect based on alternate data like income proof, location, KYC, etc. This is where ‘Good Faith’ comes into play. In simple terms, you cannot get the data if you don’t lend. And Credit Bureaus don’t lend.

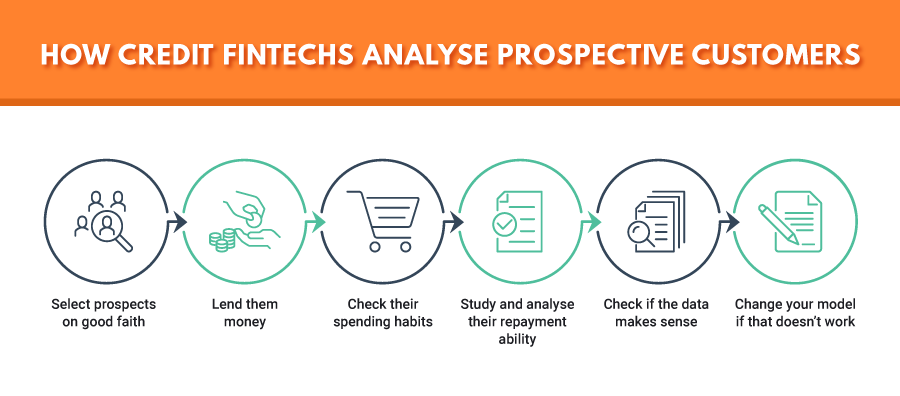

Visual Representation – Provisional scoreboard (making sense of alternate data or how fintechs study their future customers)

Step 1: Select prospects on good faith

Step 2: Lend them money

Step 3: Check their spending habits

Step 4: Study and analyse their repayment ability

Step 5: Check if the data makes sense

Step 6: Change your model if that doesn’t work

For years, many fintechs and digital lenders carried out experiments on a large scale to study the pattern and behaviour of their customers. TransUnion might be a late entrant, but they have the advantage of having observed and analysed the credit behaviour of people for years.

For example, Ram’s profile will be analysed using the CreditVision NTC Score and compared with similar customers who cleared their dues on time. If the patterns match then Ram’s application for a loan will tend to get approved.

A chance for the banks to shine

Credit is a serious business and MoneyTap’s model is trusted and has been around for years, thanks to our rigorous testing and analysis of NTC customers. Other forward-thinking Fintechs and lenders rely on similar models that they have confidence in.

I believe that TransUnion CIBIL’s model will allow banks to also start catering to NTC customers because banks lend based on a credit score. Now that TransUnion CIBIL has come up with a product that evaluates NTC prospects, it’ll be easier for banks to assess the applicant’s repayment ability and approve loans.

We have 800 million debit cards and only 45-60 million credit card users in India. Only about 4 to 5 percent of the entire population have received credit from banks. The credit scenario is clearly underpenetrated in India and the size of our population will provide enough room for banks and fintechs to grow.

Even if banks try TransUnion CIBIL’s CreditVision NTC Score, fintechs needn’t be worried about banks launching new NTC products because as a Fintech player, we have long maintained that our ecosystem also works well with collaboration. We have collaborated for years with leading Banks, NBFCs and other credit organisations. But, here are more reasons why we aren’t worried:

- Catering to NTC customers involves high risk

- Evaluating prospects will increase operational costs

- To make profit banks have to charge high-interest rates

- Banks do tend to prefer to play it safe by keeping their interest rates low

- Banks won’t lend without a credit history

Back to the future

Be it banks, fintechs, NBFCs, or digital lenders, everybody has their own recipe to judge credit applicants. We don’t know what goes inside everybody’s credit model but we do know that the data is more or less the same.

Will Fintechs and MoneyTap switch over to TransUnion’s new product immediately? No. But we will be very interested to experiment and explore the product.

Therefore, TransUnion CIBIL’s CreditVision NTC Score needs to be approached as an experiment. Banks and fintechs can use the product for 12 months, observe the repayment data and see if it works.

Yes, the approach is different, but this is a model that promises to qualify NTC customers and expand the market. In the near future, this will create more opportunities around co-lending, boost partnerships and even help launch co-branded products.

Perhaps, what this will ultimately lead to is a stronger alliance between banks and fintechs? We hope so!

Get it on playstore

Get it on playstore Get it on appstore

Get it on appstore