Topic

- Around India with MoneyTap 1

- Consumer Durable 1

- Credit Cards 32

- Credit Score 27

- Finance 33

- General 52

- Know MoneyTap Better 26

- MoneyTap 50

- MoneyTap in Daily Life 38

- Personal Loan 86

- Shopping on EMI 4

- Wedding Loan 1

If you’re someone who has ever applied for a loan or a credit card, then you’re probably familiar with the term CIBIL score. CIBIL score is a three-digit number that ranges between 300 and 900 and reflects your creditworthiness. The higher your score, the better your chances of getting approved for credit and loans.

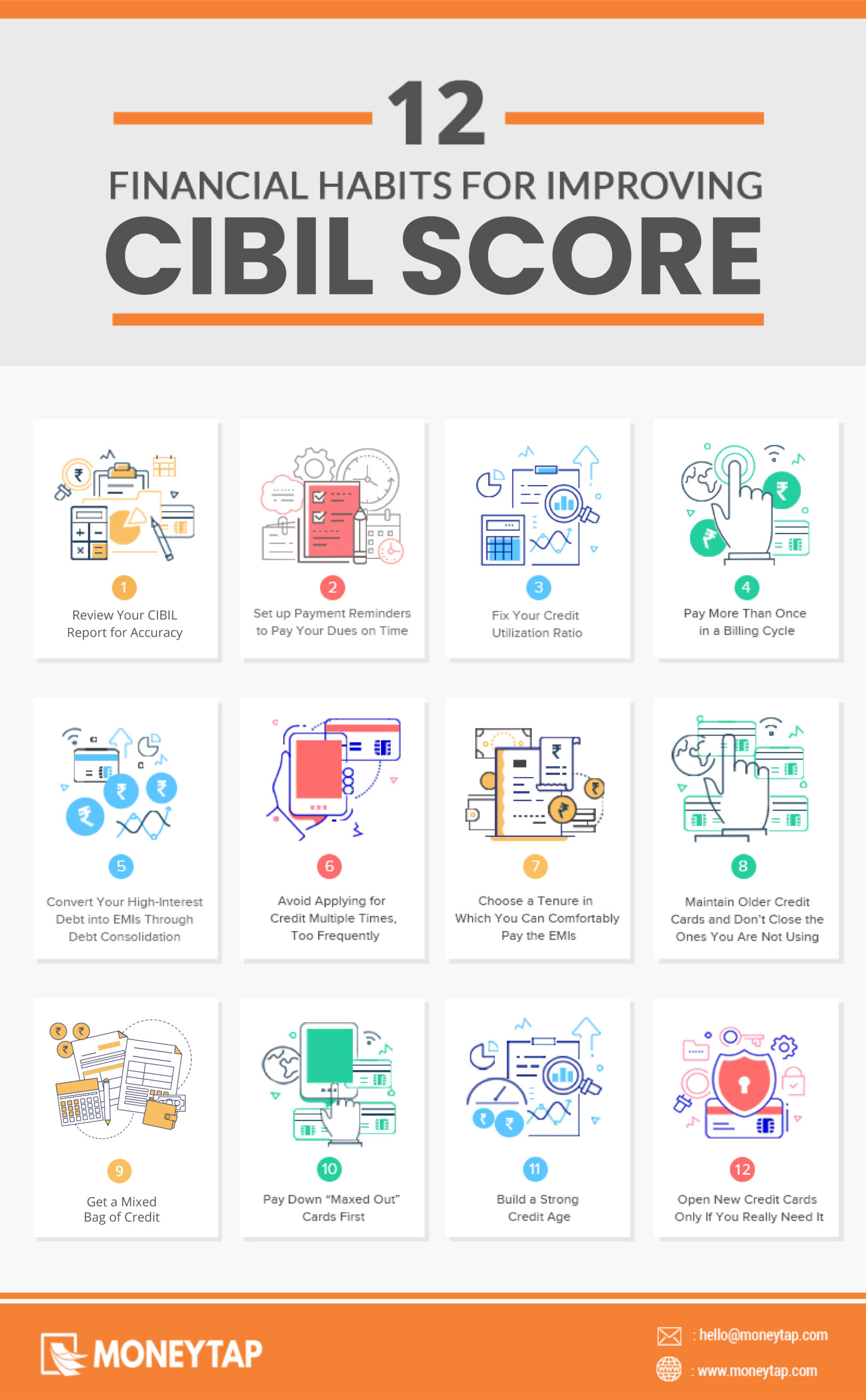

However, if your CIBIL score is low, you may face difficulties in obtaining credit. In this blog post, we’ll share 12 sure-shot ways to improve your CIBIL score, which can help you achieve your financial goals. So, without further ado, let’s dive in and explore these tips!

-

Review Your CIBIL Report for Accuracy

It’s extremely important to ensure that all information on your CIBIL report is accurate. A mistake or a discrepancy that’s reflecting on your CIBIL report can negatively impact your CIBIL score.

If you notice any inaccurate information, outdated information or missing information, raise a dispute with the Transunion CIBIL and your lender. This is the closest you can get to a quick CIBIL fix.

Remember: Pulling your own CIBIL report does not impact your CIBIL score.

-

Get a Mixed Bag of Credit

You’ll want to establish a mix of credit types, with some short-term low-interest loans, a few credit cards, and a few secured long-term loans like car loans or home loans. This helps you build up your credit score and shows lenders that you can manage your finances responsibly. Taking too many unsecured loans might seem like a negative to the banks; therefore, maintaining a credit mix with both secured and unsecured loans becomes important.

-

Set up Payment Reminders to Pay Your Dues on Time

Consistently paying your bills on time can raise your score within a few months. A single missed or late payment can have a significant negative impact on your credit score. To ensure that you pay your dues on time, write down payment deadlines for each bill in a planner or calendar and set up reminders online.

You can also consider enrolling for auto payments through your lender or bank to have your payments directly debited from your bank account.

-

Fix Your Credit Utilization Ratio

If your credit card account balances exceed 30% of your credit limits every month, it’s a red flag because your CIBIL score is suffering. Even if you are paying off your balances in full every month on the due date, it may reflect as outstanding in your credit report because your creditor reports the information to the credit bureau once a month and the date could be before your due date. So, it’s a good idea to consider pre-paying some of the balance before the due date to keep you above the 30% mark every month.

-

Convert Your High-Interest Debt into EMIs Through Debt Consolidation

If you are having trouble making your payments because of the high-interest loan rates on credit card accounts and other loans, convert your multiple debts into EMIs by paying it off using a low-interest personal loan through debt consolidation. You can then choose your repayment schedule according to your financial capability and pay back the borrowed amount through affordable EMIs. The advantage of taking a personal loan to pay off your existing debt is the interest rate; it’s nearly half of credit card interest rates.

-

Pay More Than Once in a Billing Cycle

Making payments once in a month is good but not great for your CIBIL Score. Your creditors report balances to the credit bureaus every month. If you have big balances, it could mean that you are overusing your credit.

If you enjoy good financial standing, the best thing you could do is pay more than one monthly payment. It definitely reduces your debt faster; it also reduces your credit utilization ratio and improves your CIBIL Score.

-

Pay Down “Maxed Out” Cards First To Lower Credit Utilization Ratio

When you are using multiple credit cards, it is advisable to pay down the card that’s about to max out the limit first. This strategy will help lower the credit utilization ratio and give a boost to your CIBIL score.

-

Build a Strong Credit Age

A good average credit age would be more than 5 years. The longer your positive credit history is, the better is your credit score.

If your credit history is short, there’s not much you can do. One option: Piggyback to be an authorized user on a family member or a friend’s credit card if they have a good and long credit history. However, it’s easier said than done because it may be challenging for you to find somebody who willingly adds you as an authorized user because they would be the ones responsible for any charges you make on the credit card. Other option: Be patient and don’t close any accounts.

If you have no history at all, it may take three to six months from the beginning date to see any activity being reported on your credit reports. One option to establish a credit history is to take a credit card, make small purchases that you can afford to repay, and pay the balance in full every month.

Remember: Use your credit card wisely. Otherwise, instead of helping you establish a credit history, a credit card can get you caught in the web of debt.

-

Maintain Older Credit Cards To Build a Long and Healthy Credit History

As mentioned in point 7, the age of your credit history has a significant impact on the CIBIL score. It reflects your experience in handling credit. If you’ve old credit cards, it’s important that you maintain them and keep paying the bills on time in full every month. Do not close them, even if you are not using them anymore. If you must close, close the newer ones.

Keeping your old credit cards open helps you build a long and healthy credit history, thus improving your credit score.

-

Open New Credit Cards Only If You Really Need It

Think deeply about whether you need to open additional credit card accounts at all. Having many open accounts that you are not using will only accrue charges while giving you no other major edge if you are working to improve CIBIL score.

-

Avoid Applying for Credit Multiple Times, Too Frequently

Every time you apply for a new credit account, the lender pulls up your credit report. Every pull is considered a hard inquiry, which can lower your score temporarily. Refrain from applying for several loans or credit cards within a short time. Keep your hard inquiries to a minimum by shopping around, comparing the offers, and then applying with the lender offering you the best deal.

-

Choose a Tenure in Which You Can Comfortably Pay the EMIs

As mentioned in point 2, regular and timely payments improve CIBIL score. So, when borrowing a loan, it’s always safe to choose a longer repayment tenure. This ensures lower EMI, which you can comfortably pay, thus decreasing the chances of defaulting, delaying or skipping your EMIs.

Remember: If you can afford to pay larger EMIs, choose a shorter tenure. By doing so, you’ll pay off the borrowed money faster and save money on interest.

In short, if you want to improve CIBIL score, focus on reducing your high outstanding amounts and maintain a healthy credit history by making timely payments and managing your credit accounts in a disciplined manner. You might not be able to fix your CIBIL immediately, but with patience and consistency and a little help from MoneyTap, you will succeed in the end.

Get it on playstore

Get it on playstore Get it on appstore

Get it on appstore