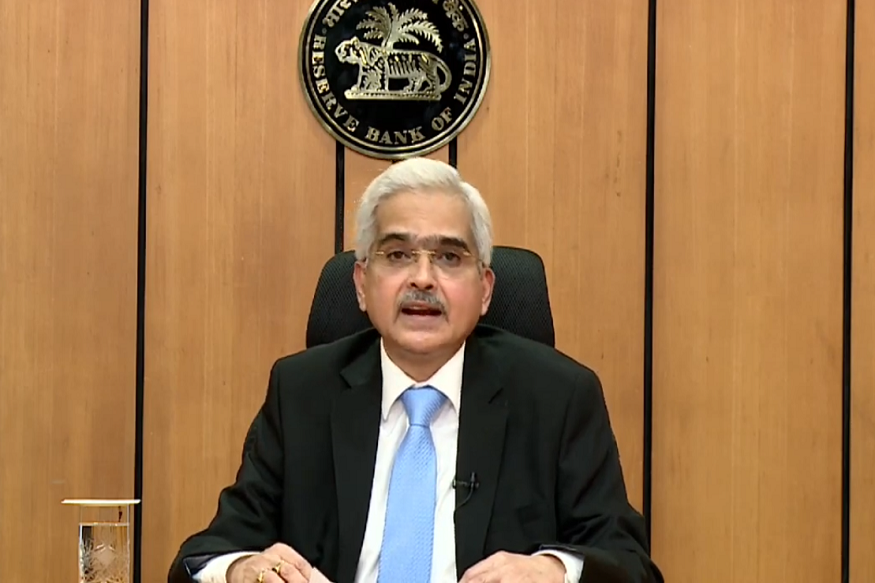

RBI Takes Liquidity-Boosting Measures to Ease Concerns of NBFCs

Topic

- Around India with MoneyTap 1

- Consumer Durable 1

- Credit Cards 32

- Credit Score 27

- Finance 33

- General 52

- Know MoneyTap Better 26

- MoneyTap 50

- MoneyTap in Daily Life 38

- Personal Loan 86

- Shopping on EMI 4

- Wedding Loan 1

On 17th April, the RBI announced a slew of liquidity-boosting measures to accelerate the economy reeling under the COVID-19 crisis.

In a bid to infuse liquidity and alleviate stress in segments, where the pain is becoming excruciating – MSMEs (NBFCs, MFIs), real estate and housing, the RBI announced yet another liquidity window to respond to their distress calls.

What were the announcements?

- The RBI reduced the reverse repo rates by 25 basis points. This means that the reverse repo rate, which was earlier at 4% is now at 3.75%. While the repo rate will remain the same at 4.4%, this 25-basis cut in the reverse repo rate will nudge the banks to lend their surplus money to productive sectors rather than parking it with the RBI.

- The RBI Governor also announced ₹ 50,000 crores TLTRO 2.0 (Targeted Long Term Operation) to banks to lend to NBFCs and MFIs. However, this is the second time TLTRO is announced. When TLTRO 1.0 was launched, banks were unwilling to take the risk of lending money to severely impacted companies, which were on slightly on the low credit ladder. So, they channelled the funds through TLTRO 1.0 and lent it to public sector entities and large corporates with higher credit ratings. This time, however, the RBI has mandated banks to invest at least 50% of the fund in investment-grade papers issued by smaller non-bank lenders.

- Simultaneously, another ₹ 50,000 crores are made available to SIDBI, NABARD and NHB so that they can lend to the smaller firms, NBFCs, MFIs, and real estate sector.

TLTRO, Repo and Reverse Repo: What do they mean?

Repo Rate: For banks to have enough money to lend, they borrow it from RBI. The interest rate at which the banks borrow money from the RBI is called the “repurchase rate” in short the repo rate. Banks make a profit by lending this borrowed money at a rate higher than the repo rate.

Reverse Repo Rate: It is the rate at which the banks park their surplus funds with the RBI.

At such a crucial time, when the economy is in shambles, the banks were parking their money with RBI instead of lending it out. So, the RBI widened the difference between borrowing and lending, making lending the surplus money to the RBI less attractive for the banks. Thus, through these changes, the RBI is giving the banks a nudge to put their money elsewhere and provide support to the weakest segments of the economy.

That’s not all.

The RBI also introduced TLTRO 2.0 (the targeted long term repo operation). It is the ability of banks to borrow at short term rates (lower interest rates) for long term purposes.

Why is this important?

Kunal Varma, CBO and Co-Founder of MoneyTap says in an article published by Economic Times, “The latest TLTRO announcement from RBI aimed at injecting around Rs 50,000 crore of additional liquidity into the banking system, specifically via banks to small and mid-sized NBFCs and MFIs is a well-timed move. This will increase the availability of credit to the end borrowers, hopefully at lower or more competitive interest rates.”

The lockdown, due to COVID-19, has put the entire country into a business coma. Although the businesses are in the lockdown phase, they still need money to pay rent, pay salaries and stay alive. Through these measures, the RBI is trying to push money in the system, so that when the pandemic goes away, these companies can recover and resume their business faster.

Get it on playstore

Get it on playstore Get it on appstore

Get it on appstore