What Is Loan Repayment and Why Is It Important?

Topic

- Around India with MoneyTap 1

- Consumer Durable 1

- Credit Cards 32

- Credit Score 27

- Finance 33

- General 52

- Know MoneyTap Better 26

- MoneyTap 50

- MoneyTap in Daily Life 38

- Personal Loan 86

- Shopping on EMI 4

- Wedding Loan 1

What Is a Loan?

A loan is the money you receive from a bank or financial institution in exchange for a commitment to repay the principal amount with interest.

Since lenders take the risk of a possible default, they charge a fee to offset this risk – and this fee is known as the interest.

Loans typically are secured or unsecured. In a secured loan, you need to pledge collateral to get the loan. So, if you default or do not pay back the loan, the lender has a right to take possession of the asset that had been pledged as collateral.

An unsecured loan doesn’t ask for collateral. If you do not pay back the unsecured loan, the lender has no right to take anything in return.

Common types of loans people take are home loans, car loans, personal loans, education loans, business loans, personal line of credit, debt consolidation loans, etc.

What Is Loan Repayment?

Loan repayment is the act of paying back the borrowed money to the lender. The repayment occurs through a series of scheduled payments, also known as EMIs, which include both principal and interest.

How Loan Repayment Works?

Loan repayment generally occurs through equated monthly installments (EMIs). These installments are the amount of money that is repaid to the lender every month. It is made up of two components – the principal amount and the interest on the principal amount, paid to the bank or lender on a fixed date each month until the total amount due is paid up over the loan tenure.

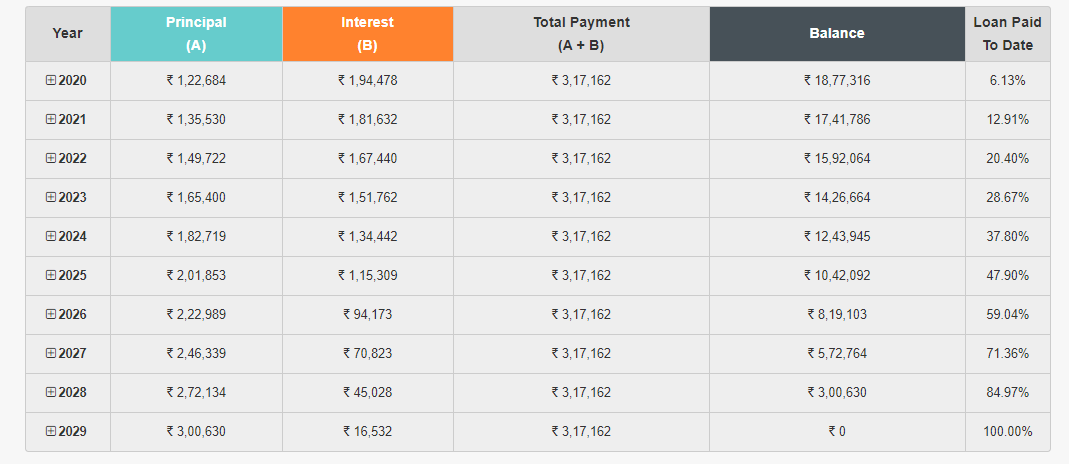

Now, you might assume that the principal and interest components are divided equally in an EMI. However, that’s not the case. In the initial loan period, the interest component in an EMI is higher. And in the latter period of the loan tenure, the interest component reduces, and the principal components gets higher.

Let’s explain this with an example.

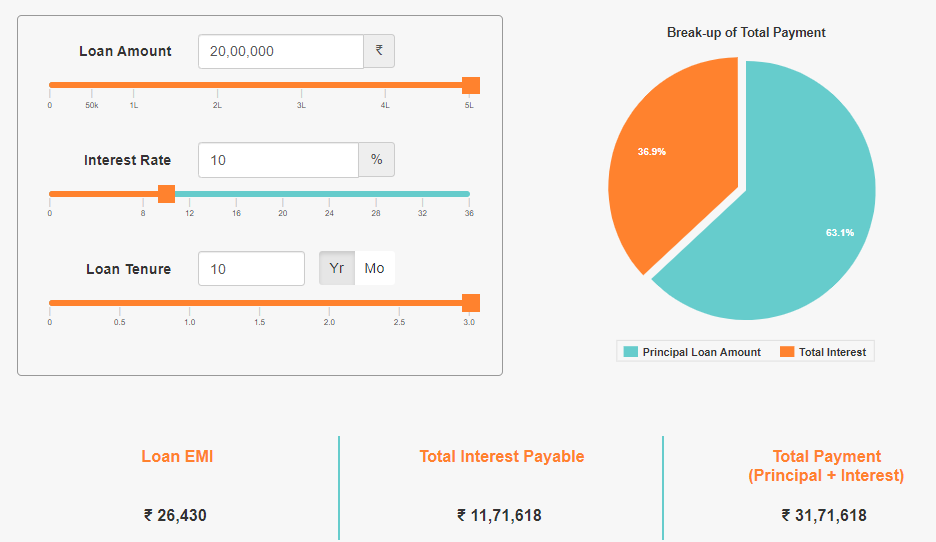

Assume that you have a loan of ₹ 20 Lakh at an interest rate of 10% for a loan tenure of 10 years.

The screenshot below gives you the breakup of the total interest component and the principal component you’ll be paying throughout the tenure of the loan.

So, on a loan of ₹ 20 Lakh, the breakup is as follows:

- EMI amount: ₹ 26,430

- Total Interest Payable: ₹ 11,71,618

- Total payment (Principal + Interest): ₹ 31,71,618

Below is the screenshot of the amortization chart. You will notice that the interest amount gradually decreases, and the principal repaid gradually increases with each passing year, leading up to the end of the loan tenure.

You can get this amortization table from your bank or you can use a loan repayment calculator. The amortization table will indicate what exactly your outstanding loan amount is at any given point of time.

The amortization table above is generated using MoneyTap’s loan repayment calculator. If you are wondering how to calculate loan repayment with interest using MoneyTap’s EMI calculator, click here. If you are wondering how loan repayment works in MoneyTap, click here.

Why Is Loan Repayment Important?

Loan Repayment should be taken seriously because not only do they reduce your loan liability and interest accrued, they are also reflected in your credit history. The immediate financial implication would be anywhere from higher interest component (for missed instalment payments) to declaring of bankruptcy (in the event of failing to repay altogether). There is also a long-term implication on your credit health which is reflected on your credit history.

How Can Loan Repayment Affect Your Credit Health?

Your credit health determines how you will perform as a user of credit. A few factors contribute to your credit health. The most notable among them are your credit utilization ratio and your repayment history. A positive repayment history is indicated if you have always made your repayments on time and never missed a single instalment. Some borrowers are unaware that their credit history with one bank is visible to all other banks through their credit report. Credit bureaus like CIBIL in India, compile such data from various sources and make it available in the form of a credit report and credit score to banks on request. This is how banks are able to check a borrower’s credit health before approving a loan.

If you have an unfavourable repayment history, it makes you a risky customer for banks. They, in turn, can opt to deny your loan application or charge a higher rate of interest; due to the perceived risk of recovering back the loan amount in time.

How Can Loan Repayment Improve Your Credit Health?

You now know how irregular repayments can have an adverse effect on your credit health. However, on the other hand, timely repayments give you a chance to build a good credit history and also improve an ailing credit health.

Loan repayment, when taken lightly, can cause unnecessary complications in the future. If you hope to build a good credit history from scratch or wish to improve your credit score, make all your future repayments regularly on time.

Types of Loan Repayment Methods

Listed below are some of the loan repayment options; however, the loan repayment option available to you may depend upon your lender and the type of loan that’s issued:

1. EMIs –Equated Monthly Installments or EMIs, are the most popular loan repayment option. Every instalment involves a part of the principal and a part of the interest, which is scheduled is pay every month over a fixed tenure.

That said, some banks allow their borrowers to pre-pay the loan after a certain number of instalments have been made. Some banks may charge a pre-payment fee, if you want to pre-pay your loan. Pre-payment can be done in two ways:

- Partial or Part Pre-Payment: This is when you pay off your loan in part, it helps you reduce the principal. This saves money on interest as the interest is applied on the new reduced principal.

- Full Pre-Payment or Pre-Closure: This is when you completely pay off your loan before the loan tenure.

2. Bullet Repayment – Some loan products may allow you to repay the loan through bullet loan repayment method. In this option, you need to pay only the interest component every month. When the loan tenure ends, you need to make one bullet repayment that pays off the entire principal loan.

Get it on playstore

Get it on playstore Get it on appstore

Get it on appstore