₹24,959

Loan EMI

₹34,90,279

Total Interest Payable

₹59,90,279

Drowning in a sea of credit card debts, other loans and EMI payments? Consolidate your debt into one monthly payment with MoneyTap.

With MoneyTap's personal loan, you can get a low interest rate loan to pay off your debt faster without any hassles.

Read more +

Receive instant approval - get a line of credit of up to ₹ 5 Lakh easily.

No additional interest charges - pay interest only on the amount you use.

Flexible repayment - repay bills using flexible EMIs while choosing a convenient repayment period - 2 to 36 months.

Use only what you need - withdraw as little as ₹ 3,000 or as high as your approved limit.

MoneyTap Credit Card 2.0 - withdraw 100% cash or swipe at stores to receive instant rewards.

All we need is your proof of address and proof of identity to get started.

₹24,959

₹34,90,279

₹59,90,279

Must be a full-time salaried employee with a minimum take-home salary of ₹ 30,000/month

ORMust be a self-employed professional with an income of at least ₹ 30,000/month.

(Only certain professionals like doctors, lawyers, or business owners qualify)While credit cards are a great way to make instant purchases when you’re short on cash, it is easy to get trapped in a credit card debt and end up with negative impacts on your financial freedom as well credit score. Avoid these issues by transferring all your dues with high interest rates to MoneyTap’s personal line of credit and simplify your finances with one affordable monthly payment!

With MoneyTap’s line of credit you will have money available instantly 24x7 to use anytime, anywhere. Click below to experience its power.

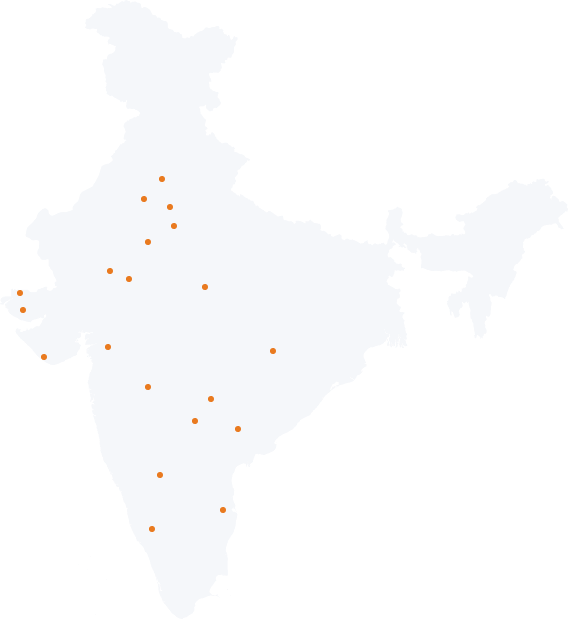

Apply now5 years and counting as India’s 1st app based Credit Line

Happy faces

Loans disbursed

Years of service

Downloads

A debt consolidation loan is a type of debt refinancing option which is used to combine all your unsecured debts into one single monthly payment.

Financing your debt in this manner makes debt management easy, provides debt relief faster, and helps recover from a poor credit.

People generally take a loan for consolidating debt to make things easier to manage by reducing the number of debts into one payment.

Getting a debt consolidation loan makes sense when your total debt is not more than 50% of your income, your cash flow is consistent, you have a good credit score, and you have planned your finances to make your debt repayments on time.

A debt consolidation loan is used as a personal loan for bad credit to pay off your debt , at once. When all the debt is cleared, the only repayment that needs to be made is for the debt consolidation loan.

MoneyTap’s personal loan offers an affordable way to make debt management easy to avoid bad credit.

You can transfer all your EMI payments and credit card debts with high interest rates to one payment that you can make with MoneyTap’s credit line and simplify your finances with one affordable debt repayment.

Here are some of the options you can use to get rid of debt:

MoneyTap’s personal loan offers a flexible and convenient way to repay debt while saving on high-interest rates and avoiding bad credit.

You can conveniently convert all your debt repayments into affordable EMIs at an interest rate that starts at 1.08% payable within 2 to 36 months with MoneyTap.

If your credit score is low (below 660) you may still qualify for a debt consolidation loan but then the interest rates can shoot up by 30%, and this may defeat the entire purpose of taking a debt consolidation loan.

People generally take a debt consolidation loan not to save money but to reduce the number of debts.

MoneyTap’s personal loan for consolidating debt helps you save quite a lot on interest while providing debt relief faster and for less money. The savings are usually from:

With debt consolidation, you are making just one monthly payment instead of multiple debt repayments. This can often make your utilization ratio go down, resulting in an improved credit score.

The interest rates on debt consolidation loans typically range from between 8.31% and 28.81% per annum (but are lower than the interest rate on credit cards), depending on the lender and your credit history.

With MoneyTap, you can finance your debt at an interest rate as low as 1.08%.