₹24,959

Loan EMI

₹34,90,279

Total Interest Payable

₹59,90,279

Almost everyone has those months when the budget gets tight. At times like these, your expenses could go a little more than what you can currently afford. If your need for cash is just ₹10,000, going through a lengthy process to get a traditional loan of ₹10,000 is not worth its while.

Moreover, most traditional banks do not entertain personal loans for amounts as low as ₹10,000. In such cases, a personal credit line can help you take a small personal loan from your approved credit limit to help bridge the gaps without you having to tap into your savings.

MoneyTap offers you a personal line of credit of up to ₹5 Lakh from which you can borrow the ₹10,000 you need to make small purchases.

Due to the coronavirus pandemic, life has gone through a sea of changes. In response to the critical situation, schools have adopted smartphones and laptops as learning tools and as a medium to deliver online classes.

If you do not have a laptop/smartphone to spare and are short on cash to buy another, a small loan of ₹10,000 can help you buy a budget-friendly smartphone, thus ensuring that your child's learning is not interrupted.

Be it a birthday or a festival; every happy occasion has to be celebrated. And there is no better way to show your love and care for your loved ones than giving them gifts. But a cash shortfall can ruin your chances to display your affection, especially if the occasion falls at the end of the month. A loan of ₹10, 000 can help

If you are wondering what gifts you can buy within a ₹10,000 price range, here are a few options:

In today's challenging job market, having specialized skills is a hot commodity. To increase your employability, get a promotion, or break into a competitive industry, enhancing your skills and knowledge through certification courses is a great idea. But paying for certification courses isn't always easy, and you might have trouble financing it. In such cases, a ₹10,000 personal loan can help.

Your reasons to buy new home appliances could be any or all of these:

However, newer models have a steep price tag. Most of the time, you might not have the funds to pay for them. Even if you do have sufficient funds, spending money in one go to get just one product may make your monthly finances suffer. So, instead of overstretching your financial capabilities, getting a small loan is a practical solution.

Some of the home appliances you can buy with a ₹10,000 loan are:

No matter how much budgeting you do, there are some expenses you just can't account for. When you need just an extra little bit of flexibility to overcome the unexpected bumps in the road that life tends to deal out from time to time, a small loan of ₹10,000 can help.

Examples of emergencies where a ₹10,000 personal loan can help:

When you have a medical emergency such as an accident or sudden illness that requires immediate hospitalization, you need urgent access to money to ensure medical expenses associated with hospitalisation, urgent medical tests, medicines, etc. are taken care of on time. In such cases, an instant ₹10,000 loans ensure that you get the medical care you need immediately without having to wait for funds.

When your car breaks down, you don't have much choice – you've got to get it fixed. But car repairs don't come cheap, and if your finances are already tight, then a few extra thousands can easily put you in a difficult position. A small loan of ₹10,000 online can take care of the bulk of the cost and get the car back on the road quickly.

Many people don't budget for unexpected home damage. So when an unexpected emergency strikes, a small loan can help you deal with repairs when you might not have the cash on hand to cover the expenses. Some of the home repairs that can be easily taken care of by a ₹10,000 loan are:

Your monthly utility bills are something you budget for every month. Due to the pandemic situation, as most of us are staying home, either working or attending online classes, we have been consuming a lot of energy for our day to day activities. Due to high consumptions of the following, it's quite possible for you to receive bills that are unexpectedly high:

A small personal loan of ₹10,000 can take care of these bills without putting much strain on your finances.

Loss of a family member is obviously an upsetting time, but it also brings the added financial difficulty, particularly when you have to travel a long distance to attend the funeral urgently. Last-minute travel is always expensive, and many people don't have that kind of money to spare. In such cases, a small loan of ₹10,000 can be a good option to help deal with this unforeseen cost.

Get Rs 10,000 personal loan or up to Rs 5 Lakh approved within 4 minutes through online application and minimum documentation.

Borrow any amount from ₹ 3,000 to any amount up to your approved credit limit as many times you want. Pay interest only on the money you borrow.

Enjoy low-interest rates starting at 1.08% per month charged only on the amount you borrow.

Get a complimentary MoneyTap-RBL Credit Card loaded with features, benefits, and rewards to use your approved credit limit for online & offline purchases and an option to convert your purchases into EMIs.

Choose the repayment schedule that suits your financial affordability. The flexible repayment option ranges from 2-36 months.

It is very easy to apply for a personal loan of ₹10,000 from MoneyTap. You can apply for a loan either on our website or by downloading the MoneyTap app.

Fill up basic details such as age, city, PAN number, & income so we can determine your eligibility.

After the approval from our system, we’ll schedule a KYC visit to your house / office to collect documents.

Credit line is ready to use! From the approved limit, transfer as much money as you need to your bank account.

The interest rate applied on MoneyTap's ₹10,000 personal loans depends on your credit score and repayment capacity. MoneyTap's interest rates on personal loans typically range from 13% to 18% per annum. When you get approved for a personal loan with MoneyTap, you'll get to see the interest rate applicable to you and the EMI amount you need to pay for the loan amount you take.

With MoneyTap's personal loan, even if you are approved for a credit limit higher than the amount you need, you can just withdraw the amount you need, i.e., ₹10,000, and repay the borrowed amount in easy monthly EMIs. The best part is that the interest will be applied to the ₹10,000 you borrowed and not the entire credit limit. You can keep the rest of the money as emergency funds and use it if you are in need of cash again.

₹24,959

₹34,90,279

₹59,90,279

With MoneyTap’s line of credit you will have money available instantly 24x7 to use anytime, anywhere. Click below to experience its power.

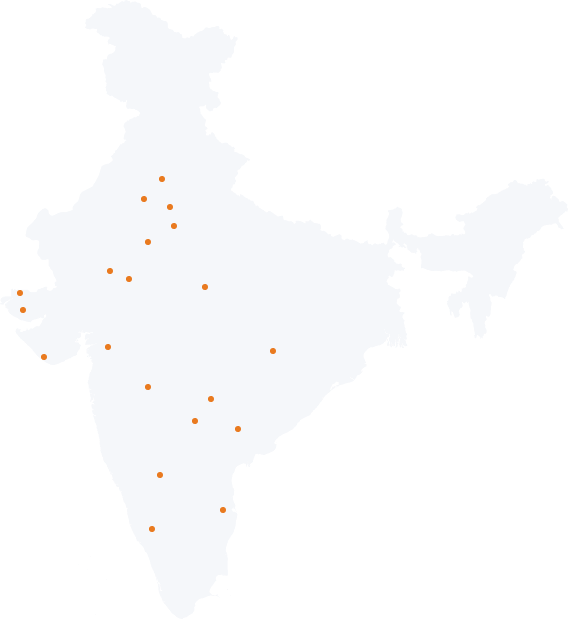

Apply now5 years and counting as India’s 1st app based Credit Line

Happy faces

Loans disbursed

Years of service

Downloads

Some of the factors you should consider before applying for a personal loan are:

No, you need to have a bank account to get a personal loan from any bank or NBFC.

Yes, you can set up an auto-debit system for your monthly payments by visiting the website of our partner bank that has approved your loan application.

In just a few minutes, you can get approved for a personal loan from MoneyTap. The loan application process is 100% online. Just download the MoneyTap app, register online, get pre-approved by submitting your basic personal details, complete e-KYC online, and get the money in your bank account upon approval!

You can also track all your transactions on the app with a single tap.

Once you submit your basic details, the loan processing begins. The loan pre-approval status is intimated to you within a few minutes. However, the final approval involves KYC verification that may take a few days more, upon which the loan amount is transferred to your bank account.

Contact hello@moneytap.com for all your queries and concerns.

Yes, your information is encrypted and safely stored in our access-controlled system that restricted access. Please go through our privacy policy to know more about our secure socket layer.

We send you reminders on your app to ensure that you don't miss making your payments. However, if you miss your repayments, your action can have the following implications:

So, the best thing you can do for a better financial future is to pay your EMIs on time.