What is a Personal Line of Credit?

A personal line of credit is a ready source of funds for personal as well as business needs. It gives you access to money, up to a certain limit. You can withdraw from the line of credit, up to your credit limit for as many times as you want and for anything you want to use it for. However, whatever amount you withdraw, you need to repay it with interest.

The interest is charged on the amount drawn from your credit line and not on the entire credit limit. The personal line of credit stays with you for life as long as you keep repaying the borrowed amount and not exceed your credit limit amount.

Types of Lines of Credit (LOCs)

Lines of credit are generally categorised into two types: Secured and Unsecured. Let’s take a quick look at both of these:

-

Secured Line of Credit

In a secured credit line, you get the loan against collateral. If you fail to repay, the lender can seize or liquidate your assets.

-

Unsecured Line of Credit

An unsecured credit line is a revolving credit account. You need not pledge collateral. The bank or the financial institution approves the credit line solely on the basis of your income and your credit score. Since the risk is greater here, the lender will charge a higher interest rate.

Depending on the purpose for which the line of credit loan is used, it can be classified as a personal credit line or business credit line.

-

Personal Line of Credit

Typically used for meeting the expenses of an urgent and immediate nature or long-drawn expenses, such as a sudden financial need or a family function or even a big purchase.

-

Business Line of Credit

It can be used for funding your business expenses, often of an ongoing nature, such as working capital requirements, wage payments, purchase of raw materials and inventory, etc.

How Personal Credit Lines Work?

A personal line of credit is designed with in-built flexibility. You can borrow the amount you need, and tailor your withdrawals according to your needs. You owe interest only on the amount you withdraw, and not on the entire credit line. If you decide not to use the line of credit, you do not have to pay any interest on it.

Once you start borrowing from your personal line of credit, the interest starts accruing and you need to start repaying the borrowed amount. You can decide to pay the entire outstanding balance all at once or make the minimum monthly payments (based on your budget or cash flow) that are spread across a tenure, which can typically range from 2 months to 5 years.

Similarities and Differences

of a Personal Line of Credit With Other Types Of Credit

Personal Line of Credit Vs. Credit Card

What’s Similar

- They are unsecured revolving credit lines.

- You can choose to make minimum payments or pay off the entire balance at the end of each month.

- They have a preset limit; you can only spend up to the credit limit.

- Your activity and payments are reported to the credit bureaus, regardless of whether you’re using them or not.

- Although most personal lines of credit do not offer rewards, there are a few rare types like MoneyTap’s personal line of credit that offers reward programs just like a credit card.

What’s Different

- A credit card is generally used for everyday purchases and spending, while a line of credit is more for ongoing or recurring expenses, big-ticket items, and business expenses.

- A line of credit usually has a higher limit than a normal credit card.

- A personal line of credit is difficult to get than a credit card.

- The interest rate applied on a credit line is much lower than that of a credit card.

Personal Line of Credit Vs. Personal Loan

What’s Similar

- They provide you an easy way to get cash when you need it.

- They are unsecured credits that don’t need any collateral. You can use the funds for whatever you need.

- They have a similar application process and credit requirements. The lenders review your creditworthiness and income to decide whether to approve or deny your application.

- Although each lender has its own set of eligibility criteria, the basic requirements for both the types of credits are similar.

- You need to have good credit for getting approval and an excellent credit score for getting credit at favourable terms.

What’s Different

- With a personal loan, the amount approved is given to you in one go. A line of credit, however, is a revolving credit. You can choose to borrow all at once or withdraw money as and when it’s needed from the credit limit approved.

- A personal loan charges interest on the whole amount that’s given to you upfront. However, in the case of a personal line of credit, the interest is applied only to the amount you draw against your credit line.

- Once you pay off your personal loan, the account gets closed. If you need funds in the future, you have to reapply for the loan. However, a personal line of credit remains active for a lifetime as long as you repay the borrowed amount regularly.

Different Ways to Use MoneyTap Personal Loan 2.0

Marriage Loan

Travel Loan

Medical Loan

Education Loan

Used Car Loan

Two-Wheeler Loan

Laptop Loan

Mobile Loan

Home Renovation Loan

Consumer Durable Loan

Debt Consolidation Loan

Used Two-Wheeler Loan

Advantages and Disadvantages of a Personal Line of Credit

Advantages

- Higher Flexibility: You can withdraw as low or as high an amount, up to your credit limit.

- Cost-Effectiveness: You have to pay interest only on the amount you borrow and not on the credit limit approved.

- Lower Interest Rate: The rate of interest levied on the loan amount is considerably lower as compared to that accrued by credit cards.

- High Credit Limit: Depending on your creditworthiness and your requirement, you can get approved for a higher credit limit that gives you the freedom to manage your financial obligations as and how you want to.

- Ideal for Business Owners: New business owners’ financial needs vary from time to time and most often than not, they do not have the funds needed to service these needs. When getting a business loan is challenging, a personal line of credit proves to be the best option because of the low-interest rate and high flexibility.

- Best for Emergency Situation: You can access funds from your credit line 24/7. This feature proves to excellent when faced with a medical emergency or any other kind of emergency that needs financial commitment.

Disadvantages

- Revolving Cycle: Since it is a revolving credit account, it is easy to keep withdrawing from the account and losing track of repayments.

- Stringent Approvals: A personal line of credit is approved only after reviewing your creditworthiness – those with poor credit history may find it challenging to get a personal line of credit.

- Closing and Maintenance Costs: Some banks and financial institutions may charge a fee for closing down a credit line and some may charge a maintenance fee to keep them active.

Tips to Consider Before Applying a Personal Line of Credit

-

Assess all costs

When you borrow a personal line of credit, there may be a few charges or fees, such as processing fees, late payment fees, and prepayment fees, etc. applied. Consider these fees before applying for the credit line to decide whether you can afford the credit line.

-

Compare the interest rates in the market

Make sure you compare the offers from various lenders to ensure that you select the offer that gives you the credit line at the lowest rate of interest.

-

Consider your needs to arrive at the right loan amount

Make a list of things you are going to finance with a credit line. Prioritise which needs you have to finance first. Decide the amount you need depending on the expenses associated with your needs.

-

Maintain a good credit history

A credit score or CIBIL score is a reflection of your credit behaviour. The score ranges from 300-900. A score above 750 is considered ideal for getting a loan approved at favourable terms. A lower credit score is a demonstration of poor debt management and may result in loan rejection or loan approval with a higher interest rate.

One of the best ways to ensure a good credit score is by paying your dues on time. Set reminders or automate your payments, if needed. -

Evaluate your ability to repay the loan

Make a repayment plan before you borrow the credit line. Ensure that your monthly income is sufficient to repay the borrowed amount. While doing so, consider your debts and other financial obligations you have to service every month. The best way to evaluate your affordability is to calculate your EMI using an EMI calculator. You can find the EMI calculator here.

Tips for When to Use (And Not Use) a Personal Line of Credit

When to use a personal line of credit

- If you need the money for home renovation projects, education costs, or other types of major and recurring expenses and emergencies, a personal line of credit may be a good idea as long as you have the plan to repay the borrowed amount.

- You can use the personal credit line to consolidate multiple smaller debts into one payment, thus saving money on interest.

What’s Different

- If you know, you can’t afford repayments, and when your income is dwindling, a credit line may not be a good idea. Because if you miss any payments, your credit is most likely to suffer, making it very difficult for you to get credit in the future.

- If you intend to take a personal line of credit to fund your basic needs or everyday expenses means that you are struggling financially, it’s not recommended. Taking on new debt is not the solution here; serious budgeting is.

Important Tips

to Make the Most of Your Personal Credit Line

A personal line of credit is an excellent financial tool. This checklist ensures that you make the most of your credit line:

- Apply for a personal line of credit only when you absolutely need it.

- Make sure you know on what you’ll be spending your line of credit.

- Withdraw only what you need from your credit line and pay it off in full before making the next withdrawal. This will help in managing your repayments better and also boost your credit score.

- When you have a personal line of credit handy, try not to use your credit card to avoid getting into a two-fold debt.

- Ensure you have a repayment plan in place.

- Choose a repayment option that suits your financial situation better.

How to Apply for a Personal Line of Credit in India?

To apply for a personal line of credit, you’ll need to submit certain documents. Below is the list of documents,

banks and other financial institutions usually ask:

Identity Proof

Proof of Employment

Proof of Residence

Proof of Income

Proof of Age

Bank Statements(Past 6 months)

PAN Card

Aadhar Card

The bank/lender will verify these documents, check your credit score and then approve or reject your request for a credit line. The interest rate offered on the credit line largely depends on your monthly income and your credit history.

How to apply for Personal Loan 2.0

Fill up basic details such as age, city, PAN number, & income so we can determine your eligibility.

After the approval from our system, we’ll schedule a KYC visit to your house / office to collect documents.

Credit line is ready to use! From the approved limit, transfer as much money as you need to your bank account.

Eligibility Criteria

-

Must be a full-time salaried employee with a minimum take-home salary of ₹ 30,000/month

ORMust be a self-employed professional with an income of at least ₹ 30,000/month.

(Only certain professionals like doctors, lawyers, or business owners qualify) - Must be above 23 years and below 55 years of age

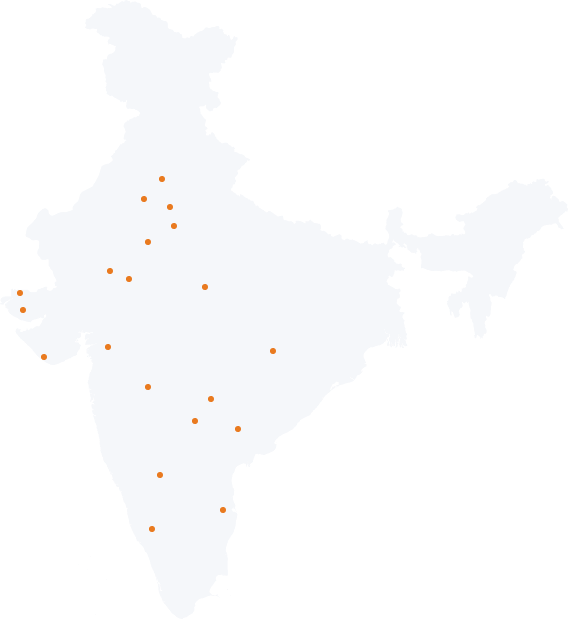

- Must be a resident of one of the following cities:

View city list

Required Documents

- Pan Card Number

- Professional Selfie

(To be taken on the MoneyTap App) - Address Proof

(Valid Driving License / Valid Passport / Aadhar Card) - ID Proof

(Valid Driving License / Valid Passport / Voter’s ID / Aadhar Card / Pan Card)

Someone like you is happy with MoneyTap

MoneyTap's Personal Loan is

Now Available Across India

Personal Line of Credit FAQs

Most banks and financial institutions, as well as NBFC entities, offer a personal line of credit in India. While stalwarts like Bank of Baroda, Citibank, Union Bank of India are in the market offering lines of credit, companies like Bajaj Finserve and new-age fintech companies like MoneyTap have revolutionised the line of credit market. Find more information on the ways to get a line of credit in India here.

Here are some of the fees that are charged by banks, NBFCs (non-banking financial company), and various Fintech companies:

- Activation/Joining Fee: You may be charged a small one-time processing fee at the time of approving the credit line.

- Rate of Interest: You will be charged interest on the amount you withdraw from your personal line of credit.

- Processing/Annual Fee: Your personal line of credit lender may charge an annual or maintenance fee, which can be anything between 1-2% of the approved credit limit. Or, you may be charged a small fee every time you make a withdrawal.

- Tax: The government taxes and levies will be charged wherever applicable.

Let’s understand this with the help of an example.

Suppose you have a personal credit line of ₹ 3 Lakh. If you withdraw ₹ 1 Lakh, you have to repay this amount plus interest in the form of EMI. If you make another withdrawal of ₹ 50,000, your outstanding amount rises to ₹ 1.5 Lakh – your interest amount increases, and your repayment amount also increases. You have to repay the borrowed amount within the decided repayment period.

Many people often rack their brains on how to increase the credit limit of their line of credit. There are various means to increase the line of credit limit. One of the ways is to request a line of credit limit increase with your lending institution. Before opting for this approach, the key question to ask yourself here is, “Does requesting a credit limit increase hurt my credit score?” The answer is yes, it may. Requesting an increase in the credit limit may trigger a “hard enquiry” into your credit report. This means that your lender will scrutinise your creditworthiness by re-evaluating your CIBIL score. Too many hard inquiries into your CIBIL score can hurt your credit score. It can have a negative impact on your creditworthiness and your future borrowing capacity.

On the other hand, if you have a very good line of credit repayment reputation or your income has increased, you may be eligible for an automatic credit limit increase. This is one of the best ways to increase your credit limit because it means that your lender trusts you and treats you as a valued and reliable customer. You are considered as one of the customers who will seldom default on repayments.

On the flipside, not repaying your line of credit dues can lead to a reduction in your line of credit limit and damage your creditworthiness.

Today you have a number of options to choose from when it comes to availing a line of credit. Fintech companies are emerging in the form of online lenders/lending platforms. They are offering a plethora of credit options to you based on your unique requirements. Maintaining an ongoing relationship with such online lenders/lending platforms is easy because it is completely virtual and hence, location-agnostic. One such fintech lending platform is MoneyTap. Their understanding of the modern consumer helps them cater to specific needs, such as a greater line of credit limit.

Just like personal loans and credit cards, personal lines of credit can be used for almost anything. Some of the situations where personal credit lines are worth considering are as follows:

- Home improvement projects: Renovating your home is an ongoing project. You can take one project at a time, get done with it before starting another one. A personal line of credit can take care of recurring expenses of home renovation projects.

- People with irregular incomes: If you work on a commission basis or are self-employed, your monthly income may fluctuate. Withdrawing from your line of credit helps you pay your bills until your next paycheck comes in.

- Emergency situations: A personal line of credit can really come handy when you encounter emergencies, such as a medical emergency.

- Projects with funding challenges: Your daughter’s marriage comes at the same time your car breaks down. A personal line of credit can help you meet the challenge.

- Business opportunity: A personal line of credit can help you grow your business by allowing you to invest in advertising, marketing, etc.

It is easy. Click on this link and enter your phone number. If you have any invite code or offer code, please enter that code in the ‘Have an invite code?’ section. Then click ‘Get OTP’.

Apply for a personal line of credit and use it wisely to make your financial life better. Download MoneyTap and get started.

Download now

Get it on playstore

Get it on playstore Get it on appstore

Get it on appstore