₹24,959

Loan EMI

₹34,90,279

Total Interest Payable

₹59,90,279

Finding it difficult to keep up with your finances in order to keep your business running? MoneyTap’s line of credit is perfect to use as a personal loan for self-employed to help your business thrive.

Apply Now

For a self-employed entrepreneur in the early years of business, getting a traditional business loan is challenging because banks need a comprehensive business plan, a thriving facility, and a reliable cash flow. Lack of access to funds cripples their plan to grow their business.

MoneyTap’s personal loan for business is designed to give the flexibility and ease of access self-employed businessmen need for business growth. This unsecured loan is offered to businessmen after evaluating their personal income and creditworthiness and not of their business.

MoneyTap’s personal loan for self-employed business is perfect for the following business scenarios:

Would you believe if we say that the pre-approval is almost instantaneous? Well, it’s true. All you need to do is download the app and register. You will get instant pre-approval on the app without having to wait or call anyone.

This feature makes it one of the most affordable loans in Vadodara. Unlike other loans where you have to pay interest on the entire limit from day 1, with MoneyTap you only pay for the amount you withdraw, whenever you withdraw it. If you don’t use it, you don’t pay any interest rate on it.

Is it an instant cash loan? Is it a credit card? Well, it’s both! MoneyTap allows you to use the line of credit the way you want, at no extra cost.

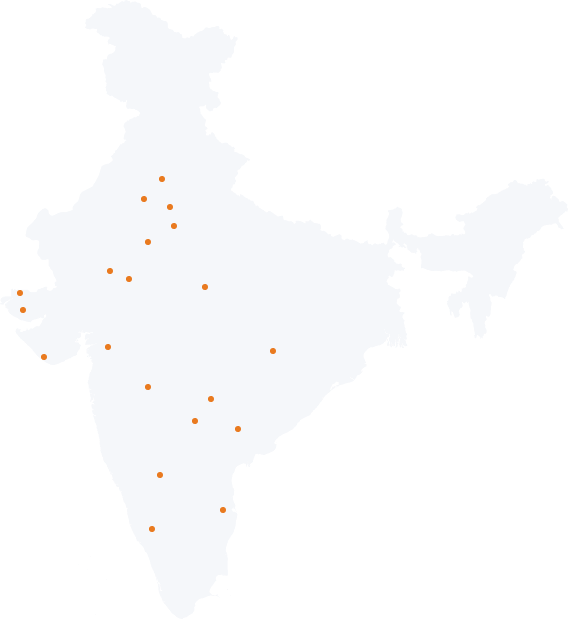

You can rest assured that your personal data and money is safe with MoneyTap. We use the best encryption systems available to ensure that none of your information is vulnerable at any stage. MoneyTap is offered in partnership with leading banks in India.

This basically means that once the line of credit is approved, you don't need to re-apply the next time you want a quick cash loan in Vadodara. You can keep the credit line for as long as you wish, even after repayment. At no extra cost.

Must be a full-time salaried employee with a minimum take-home salary of ₹ 30,000/month

ORMust be a self-employed professional with an income of at least ₹ 30,000/month.

(Only certain professionals like doctors, lawyers, or business owners qualify)₹24,959

₹34,90,279

₹59,90,279

Fill up basic details such as age, city, PAN number, & income so we can determine your eligibility.

After the approval from our system, we’ll schedule a KYC visit to your house / office to collect documents.

Credit line is ready to use! From the approved limit, transfer as much money as you need to your bank account.

A personal loan for businessman can be used to build your infrastructure which will help you build a peaceful environment to work in, thus enabling you to grow your business in size and revenue.

The personal loan for self-employed can help you take care of your ancillary expenses, such as salaries, raw material, utility bills and supplies without slowing down your operational activities when in a cash crunch.

To cater to the demand for your product or service, you may need to introduce new technology or increase production capacity by adding new equipment/machinery. A personal loan for self-employed may help you meet the demand for additional capital without it being an extra financial burden.

Inventory is a big expense, but you have to keep on replenishing your inventory to keep up with the demand. Personal loans for self-employed individuals can help you with purchasing inventory to grow your business.

If you are a small business owner, it is usually a challenge to manage cash flow and meet the liquidity requirements for working capital, such as rent, overhead salary, utility bills and inventory management; a personal loan for business owners may be the solution.

If your small team is overburdened, there is a risk of your business model failing over a period of time. As a business owner, taking a personal loan for businessman can be the best option to meet the expenses of hiring new employees so that you can even out the burden and focus on growing your business.

If you seal a good deal, you may need to increase the production capacity of your business, and that may require you to purchase raw material to cater to the high demand. A personal loan for self-employed may be the solution here.

If you plan to expand your business to another city, you will need more capital. You may need money for up-scaling your production, launching a new product, opening a new division or penetrating a new market/area. A personal loan for self-employed can give you wings to fly.

MoneyTap's personal loans for self-employed have interest rates starting at 1.08% per month (13% pa). However, the interest rate is applied only on the loan amount you borrow or use. The processing fee is 2% + GST.

Documents required for MoneyTap's personal loan for business are as follows:

With MoneyTap, your personal loan for self-employed gets approved within minutes. The final approval happens once we receive all your documentation. The money is then disbursed to you. You then have money at your disposal whenever you need it – 24 hours a day, 7 days a week with just a tap of a button.

MoneyTap's personal loan for self-employed has a minimum loan limit of ₹ 35,000 and the maximum is up to ₹ 5 Lakh.

Unfortunately, traditional banks’ terms and conditions are strict. Therefore, getting a business loan from them is difficult.

If you are not able to get a small loan for self-employed from the traditional banks, applying for a personal loan for business is your best option. You can apply for MoneyTap’s personal line of credit and get a personal loan for businessman with instant approval without any collateral or guarantor.

Yes, it is easier to qualify for a personal loan for self-employed. The banks and lenders of personal business loan rely on your finances and creditworthiness and not that of your business. If you are in the nascent phase of your business and lack enough credentials to get traditional business funding, then a personal loan for business is your best bet.

There are various resources for small business loans. Some of them are:

Deciding on the best resource for small business loans depends on your personal business requirements. If you are in the early stages of your business, a personal loan for self-employed individuals would be the best resource for you and for that having a ready line of credit available to borrow from is a great option.

Yes, you can definitely apply for a loan to finance your startup. The benefits of taking a personal loan to fund your startup from MoneyTap are as follows:

You should choose online small business loans from online lenders like MoneyTap for your small business if you are facing any of the following situations:

If your business is a startup and you need a lesser loan amount, then a personal loan is a good idea.