How is CIBIL Score calculated?

CIBIL Score is calculated by using an algorithm that revolves around loan and credit card repayment behaviour of an individual. The following 6 key factors are taken into consideration while calculating your CIBIL score:

-

Credit Mix

Keep a balanced mix of secured (home loans, auto loans) and unsecured credit (personal loans, line of credit). It can have a positive effect on your CIBIL score.

-

Debt to Income Ratio

Keep your debts such as credit card bills and mortgages lower than 50% of your income to improve your credit score. A higher ratio pulls down your credit score.

-

Payment History

Do not default on your EMIs. Making late payments and defaulting can negatively affect your CIBIL score.

-

High Credit Utilization

If your outstanding balance on your credit cards is high, it indicates an increased repayment burden, which can negatively affect your CIBIL Score.

-

Multiple Enquiries

If you have recently applied or have been approved for multiple loans and credit cards, the lenders may view your credit profile with caution as multiple credit applications reflect your debt burden.

-

Negative Status

Incidences like a written-off loan, foreclosure, filing for bankruptcy, account in the collection due to default in payments adversely affect your CIBIL score immediately. This warns your potential lender that you are unable to handle your finances for which they might face difficulty in recovering their money.

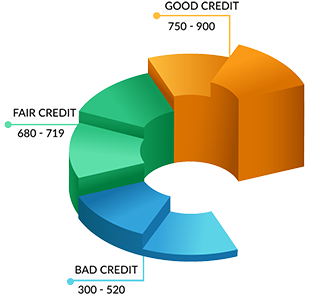

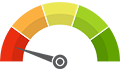

What is a Good CIBIL Score?

Any score higher than 700 is a good CIBIL score. In other words, a score between 700 and 900 is what you should aim for. It indicates that you have been regular with your payments, and banks and financial institutions find you creditworthy. Some of the benefits of having a good credit score are -

- A good credit score will fetch you better credit cards with higher limits and better deals.

- Higher chances of getting a home loan, car loan, or personal loan. Since banks are assured of your financial behaviour and creditworthiness, they won’t reject your loan on this account, at least.

- A good CIBIL score can help you negotiate or get a lower rate of interest on your loans.

- You can bargain better and do away with extra expenses like processing fees, etc. on your loan application if your credit or CIBIL score is good.

What is a Bad CIBIL Score?

A score between 300 - 500 is considered to be a bad CIBIL score. A low, poor, or bad credit score is often a reflection of bad credit history. Hence, a bad credit score decreases your chances of getting a loan because your credit profile appears risky to the lender. Even if you are approved for a loan with a low CIBIL Score, it will be with a very high-interest rate. If your credit score falls in this range, it’s a red flag. Take serious measures to improve it.

Get it on playstore

Get it on playstore Get it on appstore

Get it on appstore