₹24,959

Loan EMI

₹34,90,279

Total Interest Payable

₹59,90,279

Medical emergencies can be extremely frightening, especially if you are unprepared! While many people have started investing in medical insurance, a large number of people are still uncovered, especially for emergencies. And at times, even insurance will not cover certain medical expenses.

In times like these, with MoneyTap you can take personal medical loans to make sure that you and your family are well-protected, no matter what the situation might be!

Read more +

Get approved for a line of credit of up to ₹ 5 Lakh in real-time.

Pay interest only on the amount you use, as you use it and not on the entire amount.

Repay on your own terms in flexible EMIs of 2-36 months.

Withdraw as per your requirement - as little as ₹ 3,000 or up to your approved limit.

Swipe the credit card and get rewards or withdraw 100% cash.

ID proof and address proof are all we need from your end to get you started.

₹24,959

₹34,90,279

₹59,90,279

Must be a full-time salaried employee with a minimum take-home salary of ₹ 30,000/month

ORMust be a self-employed professional with an income of at least ₹ 30,000/month.

(Only certain professionals like doctors, lawyers, or business owners qualify)More often than not, medical procedures are expensive and can literally drain you of your money. However, with MoneyTap's credit line, taking a personal loan for a medical purpose will not create a financial imbalance for you.

With MoneyTap’s line of credit you will have money available instantly 24x7 to use anytime, anywhere. Click below to experience its power.

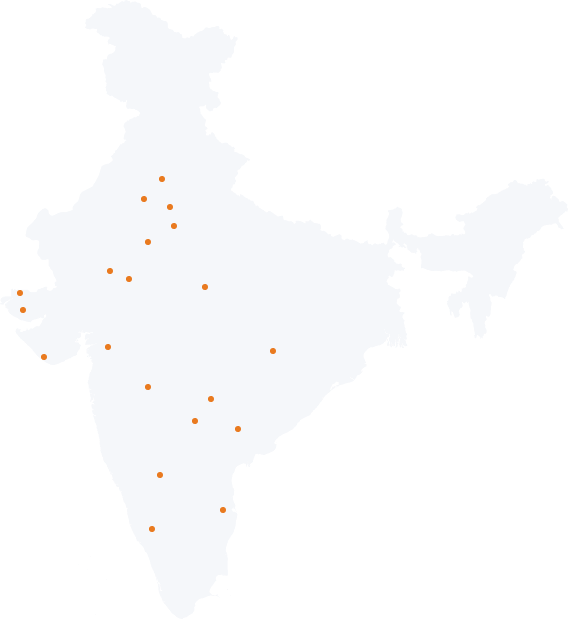

Apply now5 years and counting as India’s 1st app based Credit Line

Happy faces

Loans disbursed

Years of service

Downloads

A medical loan is a type of collateral-free personal loan that can be used in emergencies related to health or any urgent medical needs such as an operation, treatment, dental emergencies, accident or for any concerns related to health.

Yes, you can take a personal loan for meet your medical expenses.

Yes, you can take unsecured medical loans to pay for the surgery.

If you are not covered through insurance policy, here are some of the ways you can get financial help to pay for medical treatment and other hospital bills:

An excellent way to take care of medical treatment or bills is through a personal loan. MoneyTap offers unsecured medical loans in the form of a credit line as an emergency loan that is active 24/7, and you can access it anytime from anywhere and for any emergency.

To pay off your medical expenses, MoneyTap’s medical loans are the best option because of the following reasons:

To apply for medical loans from MoneyTap, you need to download the app on your phone and fill in the required information to register. After the initial approval, submit the KYC documents and once verified, the amount will be transferred to your bank account.

The interest rate for medical loans from MoneyTap starts at 1.08% per month. Interest is charged only on the amount used.