₹24,959

Loan EMI

₹34,90,279

Total Interest Payable

₹59,90,279

Get quick and easy personal loans up to ₹5,00,000 for 2-36 months. MoneyTap offers instant loans through our mobile app with minimum documentation and approval within minutes.

Apply NowNow you can get an instant MoneyTap Personal Loan of up to ₹5 Lakh without any collateral or guarantors. Use this money for travel plans, mobile phones, medical emergencies, weddings, education loans, home renovation, and more.

MoneyTap Personal Loans start at an interest rate of 1.08% per month (13% per annum). The best part is, you can get an approved credit limit of up to ₹5 Lakh, but you don’t have to pay any interest until you transfer this money to your bank account. What’s better? You don’t even have to transfer the entire amount at once; you can borrow only as much as you need from your limit. The interest will be charged only on the used amount. Repay when it’s convenient for you by choosing flexible EMI options of 2-36 months.

Apply online with 3 easy steps and get instant loan approval with minimum documentation.

MoneyTap is India’s first and most trusted app-based credit line loan. More than 10 Million people have downloaded the MoneyTap app.

Experience quick, easy, and hassle-free digital loan approval with MoneyTap’s new generation Personal Loan 2.0 and get your loan approved within minutes!

Get online approval in 4 minutes with minimal documentation. Just download the app, fill in your details and upload pictures of your documents.

Personal loans from traditional banks have cumbersome paperwork and take multiple days to provide approval.

You can borrow any amount from ₹3,000 up to your entire approved credit limit again and again, as and when you need the money. You don’t pay interest for the money you don’t use.

Loans from other banks only allow you to borrow the entire amount at once.

Since the interest is charged only on the used amount and not on the entire approved limit, you can save a lot on interests compared to traditional personal loans. Our interest rates start as low as 1.08% per month.

For personal loans from other banks, you pay interest on the entire amount from day one.

With MoneyTap Personal Loan 2.0 you also get a complimentary MoneyTap-RBL Credit Card* loaded with features and benefits. You can use this credit card for online & offline purchases and spend up to your approved limit, which you can then convert into EMIs if you want. (*Valid only for RBL approved customers.)

You can choose your repayment schedule. Choose flexible EMI options of 2-36 months and pay as per your convenience.

Banks only provide fixed EMI tenures for personal loans.

Everything is at your fingertips. With our easy-to-use mobile app, manage your account without any hassles from the safety of your home.

| Personal Loan 2.0 | Personal Loan | ||

Instant Approval |

|

|

|

Borrow in Parts |

|

|

|

Low Interest |

|

|

|

Doubles as a Credit Card |

|

|

|

Flexible Repayments |

|

|

|

Manage Credit, Repayments and Fund Transfer Through an App |

|

|

|

Must be a full-time salaried employee with a minimum take-home salary of ₹ 30,000/month

ORMust be a self-employed professional with an income of at least ₹ 30,000/month.

(Only certain professionals like doctors, lawyers, or business owners qualify)₹24,959

₹34,90,279

₹59,90,279

5 years and counting as India’s 1st app based Credit Line

Happy faces

Loans disbursed

Years of service

Downloads

Fill up basic details such as age, city, PAN number, & income so we can determine your eligibility.

After the approval from our system, we’ll schedule a KYC visit to your house / office to collect documents.

Credit line is ready to use! From the approved limit, transfer as much money as you need to your bank account.

A personal loan is money borrowed from a lender that you need to repay in monthly instalments that typically range from 2 to 5 years.

There are two types of personal loans:

To know more about a personal loan and types of personal loans, read this.

Yes, a personal loan makes perfect sense for several circumstances because it is a feasible option that gives you easy access to cash. Unlike specific loans that are granted for a particular reason, a personal loan can be used in any way you like.

No, you cannot get a personal loan from any bank or NBFC if you do not have a bank account.

A secured loan is protected by collateral in the form of a house or a car or an asset of some sort. A secured loan requires you to guarantee security that you will pay back the loan on time or lose your assets if you default.

As the name implies, unsecured loans are the exact opposite of secured loans and do not need a collateral. They include education loans, signature loans as well as credit card purchases.

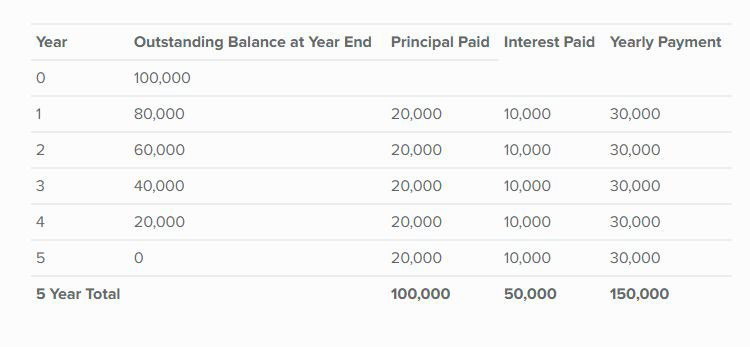

A flat interest rate is the interest rate calculated on the full loan amount throughout the loan tenure without considering the monthly EMIs that reduce the loan amount with every repayment.

Here’s an example to help you understand how the flat interest rate works for a principal loan amount of ₹ 100,000 with a yearly interest rate of 10%.

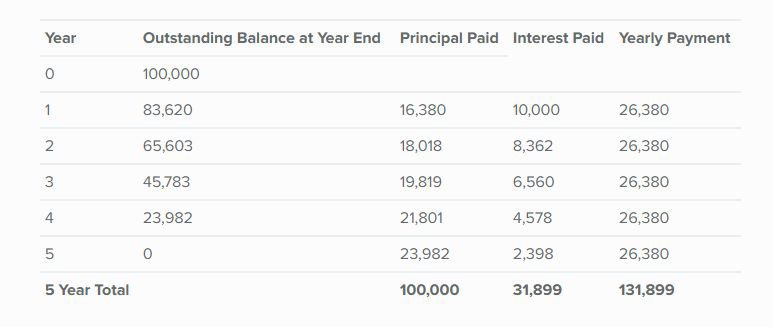

In reducing interest rates, the interest is calculated on the outstanding amount that keeps reducing with every monthly repayment. This means that the EMI is calculated every month taking into consideration both the interest on the outstanding loan amount and the principal.

Now let’s look at the same example, but this time with a reducing interest rate.

You can get MoneyTap’s line of credit for a personal loan if you are:

The interest rates for MoneyTap loans typically range from 13% to 18% annually. The exact interest rate depends on your credit score which is based on your repayment record, defaults and bounced cheques. With MoneyTap Personal Loan 2.0, you have the advantage of paying interest only on the amount you use and not on your entire approved limit. The applicable interest rates are shown to you upfront with your EMI and you are charged only after you approve it.

A good CIBIL score is a prerequisite for you to get credit. So, when you get approved for a MoneyTap credit line, use the cash and repay on time, and you start building your credit history. Taking credit and repaying on time is the best way to improve your credit score. To make sure you don’t miss out on your repayments, we send you reminders every month.

Yes, you can visit the website of our partner bank that has approved your loan application and follow their instructions to set up the auto-debit system for your repayments.

If you are able to repay the entire outstanding amount of your loan before your predetermined loan tenure ends, it will definitely help you save big on the interest because it automatically reduces.

However, if you don’t wish to prepay your entire loan amount in one shot and want to prepay a part of the outstanding loan amount early, you can do so by paying part of the total loan value at a time convenient to you. Please note that not all banks or lending platforms offer part prepayment.

No, with MoneyTap’s app-based credit line you get instant access to cash anytime, anywhere without needing any security, collateral or guarantor.

No. Being an unsecured loan by nature, MoneyTap Personal Loan 2.0 from your available credit line does not need any guarantors!

With MoneyTap, you can get approved for a personal line of credit of up to ₹ 5 Lakh for any need you may have for a personal loan without needing any collateral or security.

MoneyTap Personal Loan 2.0 is a flexible credit line with some great features like no usage-no interest, lifetime credit availability, flexible borrowing options, no collateral and no guarantors! It is a ready source of funds that can be accessed anytime for personal and professional needs. You can withdraw as little as ₹ 3,000 or the entire approved limit in one shot in case of an emergency.

Since MoneyTap Personal Loan 2.0 is a revolving credit line, you can withdraw money, repay based on your cash flow and spend it as and when you like because your credit cycle is virtually never-ending! The money upon repayment will be available again so you don’t need to reapply as long as you make the monthly payments on time.

MoneyTap’s personal line of credit can be used for just about anything – from a home remodel and a family wedding to online shopping and medical emergencies. You can also use the credit line to cover your education expenses, when travelling abroad, to buy a laptop, to pay for unexpected business expenses or for debt consolidation.

When applying for MoneyTap’s personal loan online, you need to have the following documents handy:

There is no fee for downloading the MoneyTap app and getting pre-approved for the loan. If for any reason, you don’t qualify for a MoneyTap loan, you pay zero fees but if you do, the following are the applicable charges:

No. All you need is a few minutes to follow our 100% hassle-free online process. Simply download the MoneyTap app, register online, follow the preapproval process by submitting your basic details, complete the KYC online and get the money on approval! You can also track all your transactions with a single tap.

The minimum amount that can be borrowed from MoneyTap’s line of credit is ₹ 3,000 and the maximum you can borrow is up to your approved credit limit which can be up to ₹ 5 Lakh.

MoneyTap’s personal loans can be repaid in equal monthly instalments of your choice over a convenient tenure which can be anywhere between 2 months to 36 months.

You can repay through cheque, online through the MoneyTap app or directly to the bank where it is automatically deducted with eNACH.

The processing happens instantly once you submit your basic details and the pre-approval takes nothing more than a few minutes. However, the final approval may take a few more days after you complete the eKYC.

On an average, people typically take around 4-5 minutes to get a pre-approval after they have installed the app. The speed might vary depending on your typing speed.

However, the final loan disbursal may take a few more days after you complete the KYC.

Everything from your withdrawals to your repayments can be tracked in real-time on the app.

Yes, you need to download the app because the entire process is completely online to eliminate the hassles of paperwork and ensure faster approvals. You’ll also need the app to transfer money from MoneyTap to your bank account. However, you can get pre-approved for the loan on the MoneyTap website here.

Yes, the bank will check your CIBIL score to assess your creditworthiness. The higher you score, the better are your chances of approval.

Please get in touch with us at hello@moneytap.com for all your queries and concerns. Also, do notify us in case you change your phone number as it is a critical security requirement because all your funds are tied to your number and your KYC details.

You can get approved for a credit line starting at ₹ 35,000 up to ₹ 5 Lakh from which you can take a personal loan of ₹ 3,000 up to your entire approved amount.

All the information provided by you is safely stored in our access-controlled system that has data encryption and restricted access. So, you can rest assured that all your data is safe with us. To know more about our secure socket layer, please go through our privacy policy.

You can choose from convenient EMIs of 2-36 months to repay your MoneyTap Personal Loan 2.0.

Being a revolving credit line, MoneyTap loans can have a lifetime credit limit. This is because every time you repay the borrowed amount, your credit limit gets recharged by the same amount. So, as long as you are regular with your repayments, you have the freedom to withdraw as many times as you want.

No, this is basic documentation requirement if you wish to apply for MoneyTap’s personal line of credit to borrow personal loans from.

MoneyTap's processing fee depends on the amount you are withdrawing. It's divided into the following brackets:

Note: You are charged a processing fee on the amount transferred and not on the approved limit. This fee is added to your next statement.

Yes, you can use MoneyTap’s personal line of credit to fund a small business or for managing cash flow.

We send you reminders on your app so that you never miss out on your payments but if you do miss out on your payment, it will have the following implications:

So, make sure you don’t miss out on your payments.