₹24,959

Loan EMI

₹34,90,279

Total Interest Payable

₹59,90,279

You can now buy a mobile on EMI without a credit card with MoneyTap's mobile loan instantly.

Instant approval - get a line of credit of up to ₹ 5 Lakh instantly.

Pay interest only on the amount you use.

Repay flexible EMI’s while choosing a convenient payment period - 2 to 36 months!

Withdraw as little as ₹ 3,000 or as high as your approved limit.

Credit Card to use where you wish and get rewards or withdraw 100% cash.

A valid ID proof and address proof are needed to get you started.

₹24,959

₹34,90,279

₹59,90,279

Owning a top-of-the-line, feature-loaded smartphone is now hassle-free, quick and easy, thanks to MoneyTap's mobile loan with easy EMIs.

Apply now

When you think about buying something on EMI, the first option that comes to mind is a credit card. However, not everyone has access to credit cards

Luckily, there are numerous other financial products available these days for purchasing a mobile on loan without credit card.

You can get a loan through a bank, financial institution or even an app on your phone to buy mobile on EMI amount of your choice. With app-based loans through MoneyTap, you can be approved for personal line of credit that’s both flexible and convenient.

You can use this credit line for large purchases such as mobiles, and convert your purchase amount to EMIs of your choice right through the app. You also get a credit card with your loan approval for both online and offline purchases!

Some banks and non-banking financial companies or NBFCs offer a product known as an EMI card. Essentially, these are quite similar to traditional credit options, where interest is charged on the principal amount and repayments are spread out over a certain period of time.

With some EMI cards, you may not be charged interest on the principal, but there will still be a processing fee. You need to make monthly payments within a certain timeframe until the loan amount is repaid in full.

Most people believe that only a credit card allows for EMIs, not a debit card. In fact, it is possible to convert a large spend on your debit card into easy EMIs through certain platforms. Some fintech companies offer this service, but only before you have made a purchase.

Here’s how it works. Instead of paying a merchant through your debit cum ATM card, the company offering this service makes the payment for you. In return, you need to make the down payment and EMI payments to them.

Must be a full-time salaried employee with a minimum take-home salary of ₹ 30,000/month

ORMust be a self-employed professional with an income of at least ₹ 30,000/month.

(Only certain professionals like doctors, lawyers, or business owners qualify)With the connected lives, we lead today, cell phones have become more of a necessity. Right from basic uses to more advanced features like GPS navigation, high-resolution cameras, and advanced processors; mobiles phones have become an integral part of our daily life and they often come with a hefty price tag.

This is where you can let MoneyTap make life easier for you with its personal loan offered to you as a line of credit .

A no-cost EMI or zero percent EMI is an offer that allows you to pay for a product or service in affordable monthly payments with zero interest. In simple terms, it means that you are only paying the total price of the product or service in EMIs with no extra charges. For example, if you buy a smartphone worth ₹ 21,000 at 3-month no cost EMI, you will have to pay ₹ 7,000 each month for the next three months.

With MoneyTap’s line of credit you will have money available instantly 24x7 to use anytime, anywhere. Click below to experience its power.

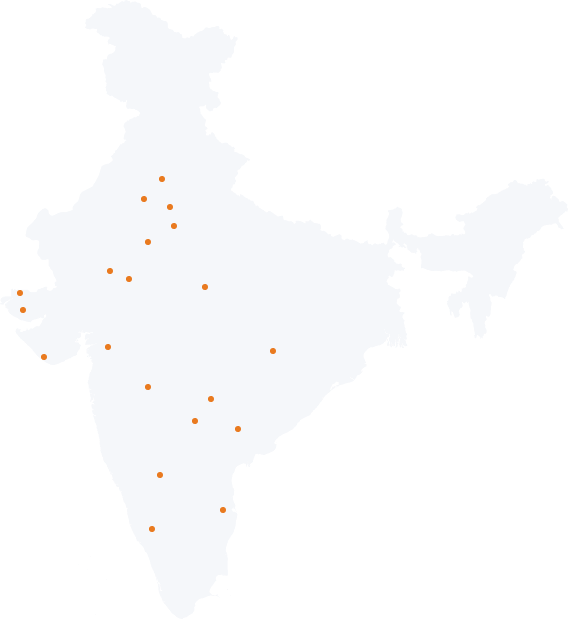

Apply now5 years and counting as India’s 1st app based Credit Line

Happy faces

Loans disbursed

Years of service

Downloads

You can buy a phone on EMI, by paying for it using any of the 4 options below and converting the payment into easy EMIs:

Cell phones are sold under attractive EMI payment schemes which makes buying smartphones on EMI without credit card a good option. Some phone vendors, online stores and financial service providers also offer no-cost EMIs.

Check for and compare rates of interest before buying smartphones on EMI. Getting a personal loan to pay for the mobile in cash and later making payments in easy EMIs is also a good option to consider.

Yes, MoneyTap's credit line allows you to get instant mobile loans to buy a smartphone without the hassles of documentation with a quick and easy loan approval process.

When you want to buy a mobile on EMI without credit card, MoneyTap’s credit line works like a mobile phone loan while being more convenient than traditional mobile loans.

MoneyTap approves a credit line in the loan amount range of ₹ 35,000 to ₹ 5 Lakh. You can withdraw as little as ₹ 3,000 or up to your approved credit limit.

Once you borrow money against MoneyTap’s line of credit, the interest starts to accrue only on the amount borrowed. And you can choose a repayment period of 2 to 36 months.

If you want to calculate your monthly EMIs, use our EMI calculator.

Some situations where no cost EMI is an ideal solution are:

When you pay for the product through regular EMIs, you pay the price of the product, plus the interest component and the processing fees. On the other hand, when you opt for no cost EMI, you can convert the product price into interest-free instalments.

No cost EMI scheme works in two ways:

Let's talk about these schemes in detail:

a) When the discount amount is equal to the interest amount: In this scheme, retailers offer discount which is equivalent to the interest amount. For example, if your mobile phone is worth ₹ 50,000. Under the 3-month EMI plan, at an interest rate of 13%, you would have to pay an interest amount of ₹ 6,500. But under no cost EMI mobiles, you give up the discount and pay the smartphone's original price.

If you choose to make an upfront payment, the phone would cost you ₹ 43,500 (discounted price). But if you choose a no cost EMI option, the same phone would cost you ₹50,000 because the amount of ₹ 6,500 which you were supposed to get as a discount is paid by you as interest.

b) When the interest amount is added to the product price: In this zero down payment mobile phones scheme, the interest amount is added to the price of the product. Let's say your phone costs ₹ 30,000. Under zero down payment mobile phones online scheme, the retailer adds the interest and offers this phone at ₹ 23,000. So, if you take a three-month no cost EMI phones plan, then the EMI amount payable by you for the next three months will be ₹ 7666. 66 per month.