Facts About Marriage Loan Interest Rate and Repayment Tenure You Should Know

Topic

- Around India with MoneyTap 1

- Consumer Durable 1

- Credit Cards 32

- Credit Score 27

- Finance 33

- General 52

- Know MoneyTap Better 26

- MoneyTap 50

- MoneyTap in Daily Life 38

- Personal Loan 86

- Shopping on EMI 4

- Wedding Loan 1

While taking a marriage loan, one little question always seems to instil fear in the heart of many borrowers: What will be my marriage loan interest rate?

You may have a great credit score to qualify for some of the best offers out there or your score could just be an average, good enough to get you a loan, but not all marriage loans are equal. They differ in their terms, interest rates and fees.

So, before you sign on the dotted line, make sure you shop around for the best rates and terms. Here’s some help. The comparison table below allows you to compare marriage loans in India.

Marriage Loan Interest Rates and Terms Comparison

| Bank/ Lender |

Loan Amount | Loan Tenure | Rate of Interest | Processing Fee |

|---|---|---|---|---|

| Axis Bank | ₹ 50,000 to ₹ 15 Lakh | Up to 5 years | 15.75% to 24% | 1.50% to 2.00% + GST as applicable |

| MoneyTap | ₹ 35,000 to ₹ 5 Lakh | 2 months to 3 years | 13% to 24.03% | 2% plus GST |

| ICICI Bank | Up to ₹ 20 Lakh | Up to 5 years | Starting from 11.25% | Starting from 0.99%, Up to 2.25% plus tax |

| HDFC Bank | ₹ 50,000 to ₹ 50 Lakh | 1 to 5 years | 11.25% to 21.50% | Up to 2.5% of the loan amount |

| SBI | ₹ 24,000 to ₹ 15 Lakh | Up to 4 years | 12.50% | 1% of loan sanctioned + Taxes |

| Bajaj Finserv | Up to ₹ 25 Lakh | 1 year to 5 years | 11.99% to 15.50% | 1.50%, Up to 3% |

| Tata Capital | ₹ 75,000 to ₹ 35 Lakh | 1 year to 5 years | 11.75% to 13.50% | From 1.50% to 2.50% |

| CitiBank | ₹ 1 Lakh to ₹ 30 Lakh | 1 year to 5 years | 10.99% to 18.99% | Up to 2% |

| Cashkumar | ₹ 50,000 to ₹ 20 Lakh | 1 year to 5 years | 10.88% to 28% | ₹2,000 (excluding taxes) or 4% of the loan amount, whichever is higher |

| Faircent | ₹ 30 thousand to ₹ 10 Lakh | 6 months to 3 years | 12% p.a. to 28% | One-time listing fee of ₹500 adjusted as processing fee |

So, now that you know what type of marriage loan offers exist, there are probably some facts about interest ratesthat you should know.That’s why you have to understand the inner workings of a marriage loan before shopping for one.

Understanding the Workings of a Marriage Loan

Wedding loans are unsecured personal loans taken to cover wedding expenses.

Banks quote interest rates on a ‘reducing balance’ basis.

Note: In a reducing balance calculation, the interest component of your EMI keeps on changing. In the initial part of the loan, it is high, but as the tenure nears the end, the interest component becomes nominal.

Calculating the interest amount you pay on your personal loan for marriage

You can use an EMI calculator to work out how much interest you’re paying. If you want to understand how it’s done, do it by hand. Here’s how:

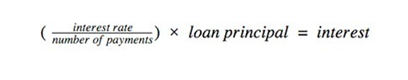

Formula:

- Divide your interest rate by the number of EMIs you’ll be making in a year. Since interest rates are expressed annually, your EMIs are divided by 12.

- Then multiply it by the balance of your loan. If it’s your first payment, your marriage loan balance will be your whole principal amount.

The result is the amount of interest you’ll pay in the first month.

Let’s take this forward with an example.

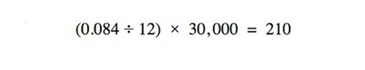

Assume you have taken a personal loan for marriage expenses of ₹ 30,000 with a loan tenure of 6 years at 8.40% p.a.

The interest you’ll pay in the first month is:

To work out the interest you will be paying in the following months, you need to first calculate your new balance. So:

- Minus the first month interest, you just calculated from the EMI amount. The remaining amount is paid towards your principal loan amount.

- Minus this amount from the original principal amount to get the new loan balance.

Let’s break up the ongoing interest payments for the next few months into a table using the above example. The calculations might look like this:

| Month | Starting balance | EMI | Interest paid | Principal paid | New balance |

|---|---|---|---|---|---|

| 1 | ₹ 30,000 | ₹ 532 | ₹ 210 | ₹ 322 | ₹ 29,678 |

| 2 | ₹ 29,678 | ₹ 532 | ₹ 207.75 | ₹ 324.25 | ₹ 29,353.75 |

| 3 | ₹ 29,353.75 | ₹ 532 | ₹ 205.48 | ₹ 326.52 | ₹ 29,027.23 |

| 4 | ₹ 29,027.23 | ₹ 532 | ₹ 203.19 | ₹ 328.81 | ₹ 28,698.42 |

| 5 | ₹ 28,698.42 | ₹ 532 | ₹ 200.89 | ₹ 331.11 | ₹ 28,367.31 |

And so on….

The significance of the repayment tenure

It is easy for most borrowers to be interest rate-obsessed when they are comparing marriage loan offers. While their focus is on a single variable that’s affecting their loan, they tend to ignore the other important aspects that could cost them big.

Instead of blindly choosing the wedding loan offer with the lowest interest rate or smallest EMI, you should look into other important factors that may have a major impact on the marriage loan cost. Loan/repayment tenure is one of them.

The question you should ask is:

Do you want a longer repayment tenure or a higher EMI for your marriage loan?

The tenure of your marriage loan can have an impact on the total loan cost, just as much, if not more than the interest rate charged on your loan.

You may sometimes face the dilemma; whether to choose a longer repayment tenure that makes the EMIs easy or shorter period that has a higher EMI but saves on interest paid out in the long run.

To arrive at a correct decision, you have to understand a few features of a marriage loan and how they affect the total amount paid.

Essential Facts You Need to Know

Here are some facts that every marriage loan borrower must keep in mind:

- The 3 factors that are considered while calculating the EMI are – the loan tenure, the loan amount, and the interest rate. See how the loan tenure affects the EMI amount using an EMI Calculator.

- Usually, the shorter the loan tenure, lower is the interest rate charged.

- The longer the repayment tenure, higher is the total amount of interest paid for the marriage loan.

Here are some facts that every marriage loan borrower must keep in mind:

- The total interest payable increases as the interest is paid for a longer time.

- The total interest increases further since the interest rate charged on the loan is usually higher.

Example: Consider that you have taken a marriage loan of₹ 1 Lakh at an interest rate of 16%.

The table below shows you how interest paid differs depending on the tenure of the loan.

| Variables | Loan Tenure of 3 Years | Loan Tenure of 7 Years |

|---|---|---|

| EMI | ₹ 3515 | ₹ 1,986 |

| Total Interest Paid | ₹ 26,565 | ₹ 66,840 |

But banks usually charge a higher interest rate if the loan tenure is increased. So, if we consider the interest rate of 18% for a loan tenure of 7 years, you will pay total interest of ₹ 76,550 on a loan amount of ₹ 1 Lakh.

How to decide which marriage loan is the best for you?

The best marriage loan will be the one that helps you find the right balance between the interest rate, the size of the EMI, and the total length of the loan.

If the lower monthly payments allow you the ability to repay your debt comfortably, it’s worth the extra cost you’ll pay in terms of interest.

The bottom line is …

If you have the financial ability to cope up with a higher EMI, then shorter loan tenure is best for you. If you cannot cope up with higher EMI, longer marriage loan tenure is advisable.

Moreover, it’s always better to choose a wedding loan that you can afford rather than the one that’s cheap.

MoneyTap’s marriage loan offers a low-interest rate, flexible EMIs and convenient repayment options. That’s obviously the balance you would want to see in your marriage loan, isn’t it? Download MoneyTap today.

Get it on playstore

Get it on playstore Get it on appstore

Get it on appstore