₹24,959

Loan EMI

₹34,90,279

Total Interest Payable

₹59,90,279

Looking to buy an AC or a new LED TV on EMI to upgrade your lifestyle? Want to refurnish your home?

Get the MoneyTap app for a personal loan with a line of credit that you can use as a consumer durable loan to purchase a wide variety of big-ticket items like ACs, TVs, refrigerators, smartphones, washing machines and other appliances on comfortable loan EMIs.

Read more +

Get a line of credit of up to ₹ 5 Lakh approved in real-time.

Pay interest only on the amount used and not on the entire amount approved for you.

Repay your card spends in flexible EMIs as you choose the payment period that ranges anywhere from 2 months to 36 months.

Withdraw as little as ₹ 3,000 or what you need or as much as your approved limit.

Enjoy 100% cash withdrawals with MoneyTap Credit Card 2.0.

You just need a valid address proof and a government recognized ID to get started.

₹24,959

₹34,90,279

₹59,90,279

Must be a full-time salaried employee with a minimum take-home salary of ₹ 30,000/month

ORMust be a self-employed professional with an income of at least ₹ 30,000/month.

(Only certain professionals like doctors, lawyers, or business owners qualify)No need to save up for years to be able to make purchases you need for your home and family to improve your quality of life. Now, with MoneyTap’s line of credit, you can simply apply for a personal loan for consumer durables and fulfil all your needs!

With MoneyTap’s line of credit you will have money available instantly 24x7 to use anytime, anywhere. Click below to experience its power.

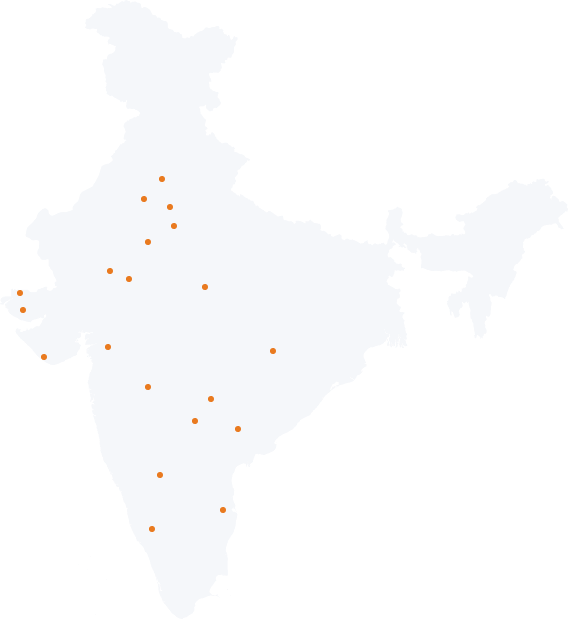

Apply now5 years and counting as India’s 1st app based Credit Line

Happy faces

Loans disbursed

Years of service

Downloads

It is a finance option that can be used to purchase one or more expensive household appliances on affordable EMIs - like an AC on EMI or an LED TV on EMI by removing your immediate financial burden.

If you don’t want to wait for a long time or dip into your savings, a personal loan is a perfect solution to add luxury to your life with zero down payments.

Consumer durable loans are unsecured loans. That means you don’t need to pledge for loan against property. That’s why lenders look at your CIBIL score and repayment history when you apply.

You can buy an LED TV on EMI with the following options:

Yes, you can buy the home electronics/appliances on EMI without a credit card by using options such as debit (ATM) cards, EMI cards, consumer durable loans or personal loans.

If you want to buy household appliances like an AC or an LED TV on EMI but don’t have a credit card you can apply for MoneyTap's easy small loan that does not subject you to the hassles of paperwork.

MoneyTap has a simple loan online process that can be completed in minutes by downloading the app on your phone and filling the required information to register.

You can then upload your KYC documents and receive an instant approval within minutes. Once approved, your amount will be ready to use as a consumer durable loan.

You can buy an AC on EMI by using options such as debit cards, credit cards, EMI cards, consumer durable loans or personal loans.

If you are shopping online, then you can choose the option “Convert into EMI” during checkout.

A consumer durable loan covers a wide range of household appliances on EMI including:

and everything that is covered under the category of consumer products.